Lake Monroe (Lockhart-Smith Canal)

Basin Study

CIP No. 02007111

BCC Districts 4 & 5

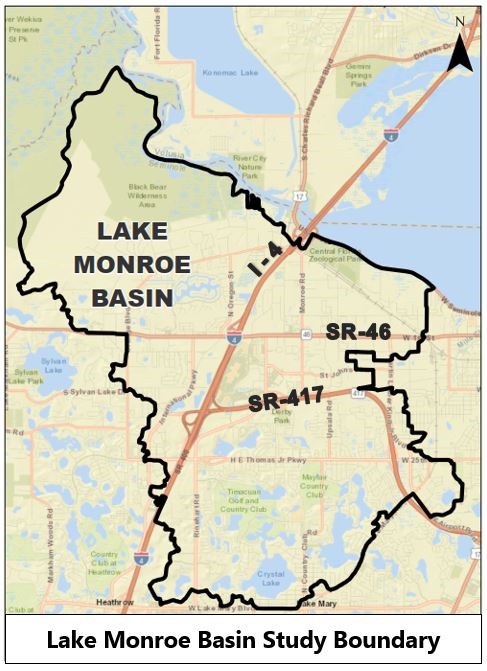

Seminole County has initiated an update to the 2002 Lake Monroe Basin study. The Lake Monroe Basin is located at the northwest corner of the County and drains to the St. Johns River or Lake Monroe. The watershed is approximately 24 square miles and resides within the St. Johns River Water Management District. It encompasses portions of the cities of Sanford and Lake Mary, as well as a large portion of unincorporated Seminole County.

This basin has received significant growth since the last study was completed. The update will:

- Incorporate developments and infrastructure improvements built since the previous study

- Identify flood-prone areas within the basin

- Estimate flood impacts to roadways and buildings

- Update the 100-year flood maps

- Evaluate and rank conceptual Capital Improvement Projects that will serve to alleviate flooding

The purpose of this website is to share the status of the project and solicit public input. This website includes presentations that detail the project purpose, data acquisition phase, results of the stormwater modeling, preliminary proposed FEMA floodplain map updates, and current status of conceptual Capital Improvement Project development.

Included is a short video presentation presented at a public meeting held April 13, 2023.

Project Location Map

Project Presentation

Send Us Your Feedback

There are several opportunities to submit questions and comments regarding this project.

Submit questions and comments via:

1. E-mail: Jorge Jimenez, P.E., Seminole County Public Works Project Manager, at jjimenez@seminolecountyfl.gov, Subject line: “Lake Monroe Basin Study – Public Feedback”

2. Telephone: Call 407-665-5753 and cite your questions and comments under the “Lake Monroe Basin Study”

3. U.S Mail: Seminole County Public Works — Engineering Division, Re: Lake Monroe Basin Study, 100 E 1st Street, Sanford, FL 32771

4. Using the Feedback Form below on this webpage

Seminole County’s One-Cent Sales Tax for County Infrastructure, known as the Penny Sales Tax, is levied on the sale of consumer goods to visitors, residents and businesses, ensuring the cost to construct and maintain infrastructure is shared. The Penny Sales Tax funds local projects, including stormwater systems, sidewalks and roadways, capital improvements to public safety, and enhancements to Seminole County Public Schools facilities. Currently in its third generation, the Penny Sales Tax is expected to generate on average $81 million per year in non-ad valorem tax revenue.