2014 County Penny Projects

One Cent Infrastructure Sales Tax

$1.8 billion

Since 1991, the One Cent Infrastructure Sales Tax has generated $1.8 billion countywide.

$102 million

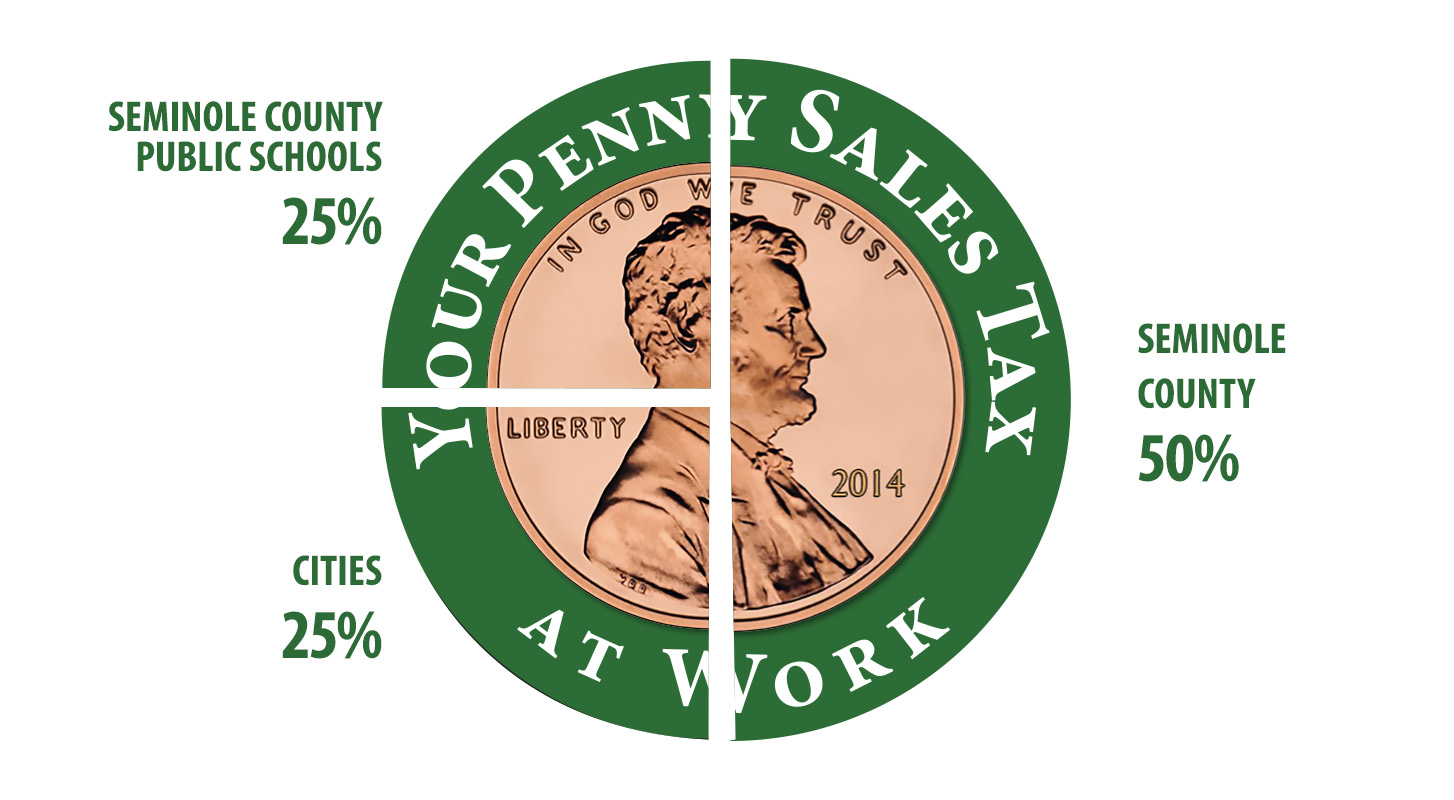

In 2024, the Penny Sales Tax generated over $102 million; of which, $59 million was collected for Seminole County projects, and remaining funds were allocated to Seminole County cities and Seminole County Public Schools.

20%-30%

Florida Department of Revenue estimates that 20%-30% of Penny Sales Tax funds are paid by visitors, not residents.

On November 5, 2024, Seminole County voters approved the Fourth Generation of the One Cent Infrastructure Sales Tax, known as the Penny Sales Tax. Funds are collected through a one percent (1.0%) local sales tax on the sale of consumer goods to visitors, residents, and businesses, ensuring that the cost to construct and maintain infrastructure is shared across the community.

The Seminole County Board of County Commissioners approved an interlocal agreement on June 11, 2024, outlining the distribution and use of Penny Sales Tax proceeds among the County, Seminole County School Board, and the seven municipalities of Seminole County. Read the interlocal agreement to learn more about the planned projects.

Revenue from the Penny Sales Tax is shared between the County, its seven cities, and the school district, supporting a range of infrastructure projects that benefit residents and enhance quality of life across Seminole County.

Types of Projects Funded By the Penny Sales Tax

Pedestrian and Bicycle Infrastructure

- Trails

- Bike Lanes

- Pedestrian Bridges

- Sidewalks

Road and Traffic Improvements

- Traffic Signals

- Turn Lanes

- Road Widening

- Roadway Resurfacing

- Mast Arms

- Bridge Replacements

- Corridor Advancements

Drainage and Stormwater Management

- Drainage Improvements

- Stormwater Ponds

- Erosion Control

- Culvert Replacements

- Shoreline Restoration

Utilities and Infrastructure

- Underground Conversions

- Fiber Upgrades

- Lighting Upgrades

- Water Quality Projects

Parking and Public Spaces

- Parking Expansion

- Playground Resurfacing

- Park Enhancements

Safety and Emergency Services

- Safety Vehicles

Projects & Project Costs

Learn more by viewing a list of projects recently completed or in progress, funded by the 3rd Generation (2014) One Cent Infrastructure Sales Tax:

- 2014 Penny Projects for Seminole County (Updated 1/19/24)

- 2014 Penny Projects for the City of Altamonte Springs

- 2014 Penny Projects for the City of Casselberry

- 2014 Penny Projects for the City of Lake Mary

- 2014 Penny Projects for the City of Longwood

- 2014 Penny Projects for the City of Oviedo

- 2014 Penny Projects for the City of Sanford

- 2014 Penny Projects for the City of Winter Springs

- 2014 Penny Projects for Seminole County Public Schools

Projects Funded by Prior One Cent Tax Referendums

The Penny Sales Tax, implemented in 10-year increments, was first passed by Seminole County voters in 1991. The 1991 and 2001 Sales Tax funded 860 new capital projects, including approximately 170 miles of new and reconstructed roadways, 75 miles of sidewalks, 30 intersection improvements, roadway drainage projects, stormwater projects, mast arm conversions, new signals and countywide fiber-optic installations.